FIXED INCOME

FINANCING FRAMEWORK-

RATINGS

Rating Agency Fibra Danhos (DANHOS 13) DANHOS 17 DANHOS 16 DANHOS23L Rating Perspective Rating Perspective Rating Perspective Rating Perspective Fitch Ratings AAA(mex) Stable AAA(mex) Stable AAA(mex) Stable AAA(mex) Stable HR Ratings HR AAA Stable HR AAA Stable HR AAA Stable HR AAA Stable - PROSPECTUS FOR DEBT ISSUANCE

-

FACTSHEET 3Q / 2025

Long Term Debt Maturity Profile

millions of pesos8003,0002,5001,3502,50020252026202720292030- Credit Line L.P

- Credit Line C.P

- DANHOS 23L

- DANHOS 17

- DANHOS 16

Relevant metrics

3Q 2025 Metric Value ARB (m2)** 1,198,753.0 Occupancy (%) 91.4% Average Fixed Rent by m2 507 Assets 78,230,856,109 Liabililities 12,713,005,839 NOI 1,492,179,924 Total Income 1,899,612,840 LTV (%) 13.0% AFFO 1,099,624,006 FFO 1,010,221,211 * Figures in Mexican pesos unless otherwise indicated

** Consider a 50% interest in Parque Tepeyac.Ticker Debt Type Currency Amount (Millions) Issuance Date Maturity Date Benchmark Rate/Spread Tenor Maturity Year DANHOS16 Bonds MXN 3,000 11/07/2016 29/06/2026 Mbono 2026 7.80% 10 2026 DANHOS17 Bonds MXN 2,500 10/07/2017 28/06/2027 Mbono 2027 8.54% 10 2027 DANHOS23L Cebures MXN 2,500 18/08/2023 09/08/2030 Mbono 2029-2031 10.67% 7 2030 BBVA L.T Credit Line MXN 1,350 26/05/2025 07/04/2029 TIIEF 28d +1.10% +1.10% 4 2029 BBVA S.T Credit Line MXN 800 08/10/2025 10/11/2025 TIIEF 28d +0.70% + 0.70% 1 months 2025 *Adjusted according to compliance with ESG indicator

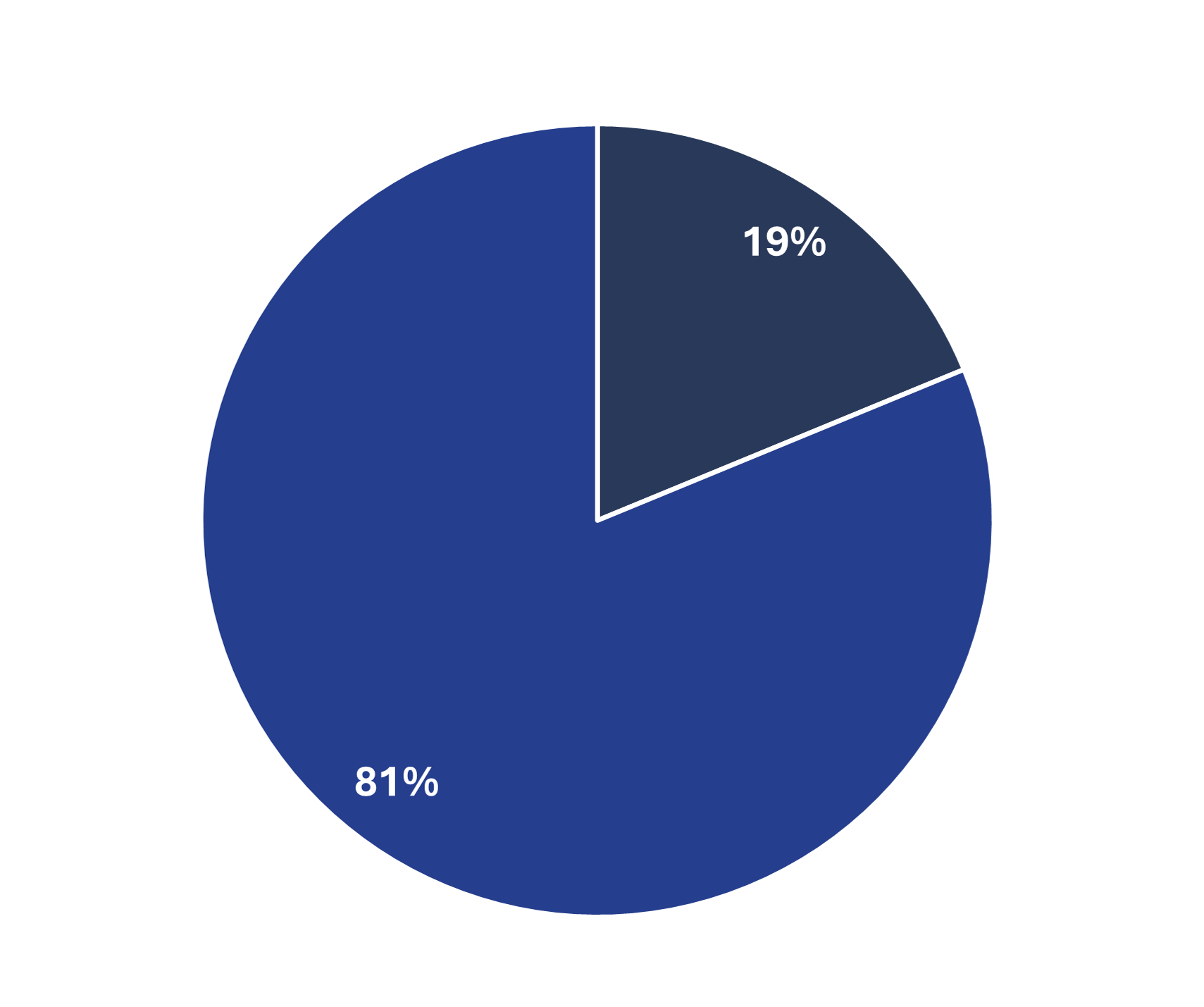

Debt Distribution by interest rate

- Variable Rate

- Fixed Rate

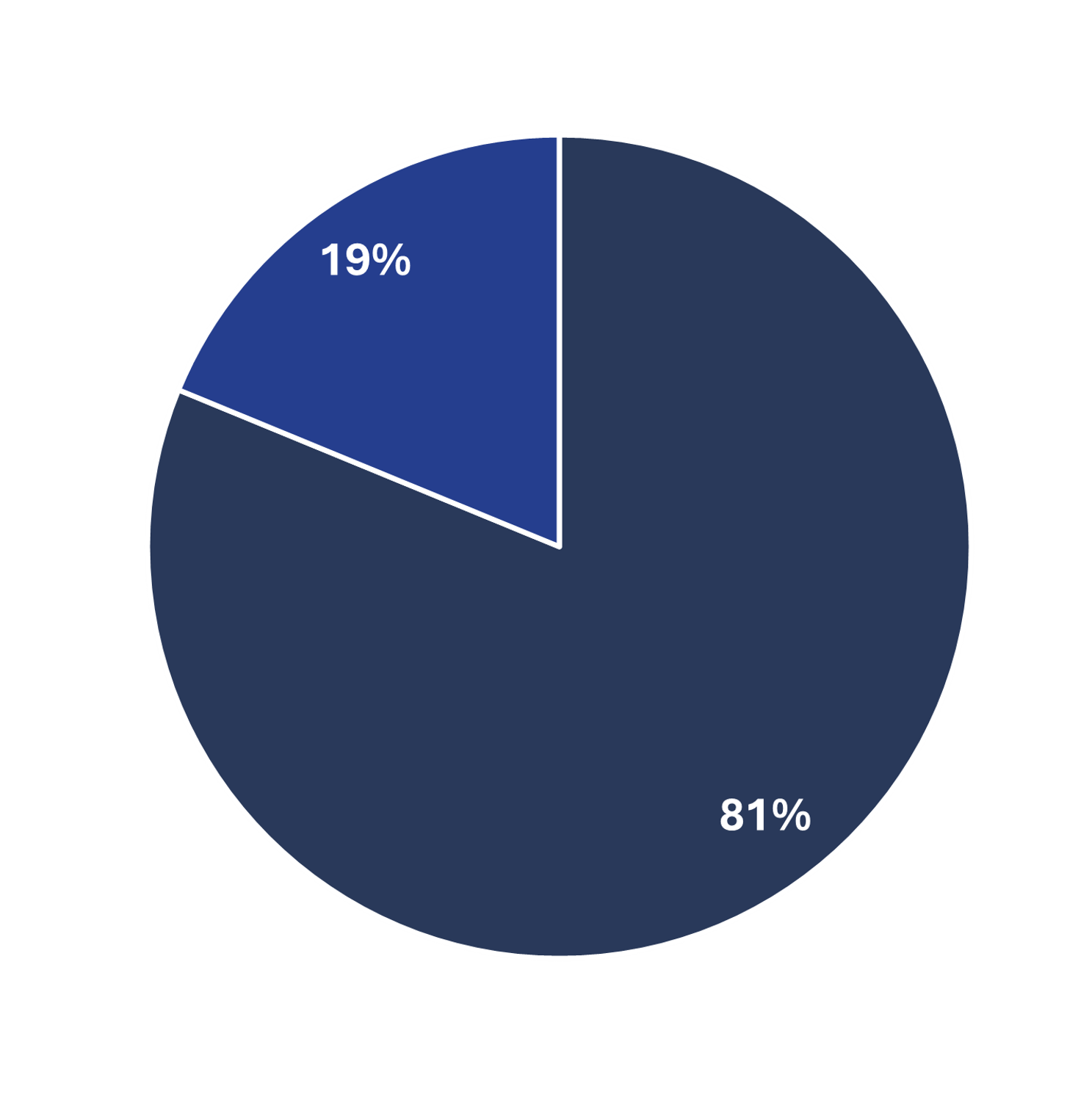

Debt Distribution by debt type

- Bonds

- Credit Line